The 25-Second Trick For Estate Planning Attorney

Table of ContentsThe Ultimate Guide To Estate Planning AttorneyAn Unbiased View of Estate Planning AttorneyAn Unbiased View of Estate Planning AttorneyEstate Planning Attorney - Questions

Your attorney will certainly additionally assist you make your records authorities, scheduling witnesses and notary public trademarks as required, so you do not need to worry concerning trying to do that final action on your very own - Estate Planning Attorney. Last, but not the very least, there is important satisfaction in establishing a connection with an estate preparation lawyer who can be there for you in the futureJust put, estate planning attorneys give value in lots of means, much beyond merely supplying you with published wills, depends on, or other estate planning files. If you have inquiries regarding the procedure and want to find out a lot more, contact our workplace today.

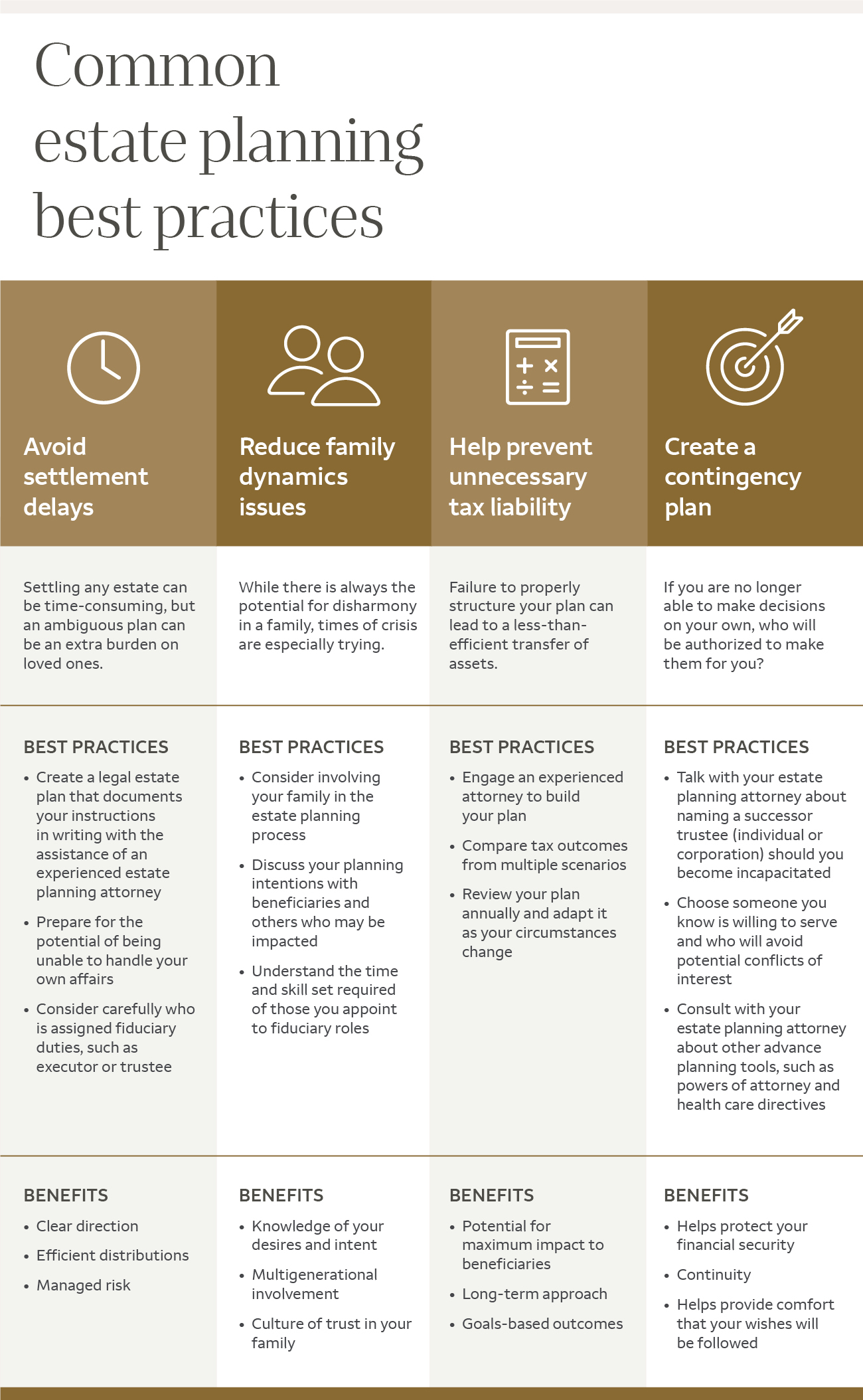

An estate preparation attorney assists you formalize end-of-life choices and lawful files. They can establish up wills, establish trust funds, create wellness care instructions, establish power of attorney, develop succession plans, and more, according to your wishes. Functioning with an estate planning lawyer to finish and manage this legal documentation can help you in the following 8 areas: Estate planning attorneys are professionals in your state's trust, probate, and tax regulations.

If you don't have a will, the state can decide just how to separate your properties amongst your successors, which might not be according to your wishes. An estate planning attorney can assist arrange all your lawful papers and disperse your properties as you want, potentially avoiding probate.

The Buzz on Estate Planning Attorney

As soon as a client passes away, an estate plan would certainly dictate the dispersal of properties per the deceased's directions. Estate Planning Attorney. Without an estate strategy, these decisions might be delegated the near relative or the state. Tasks of estate coordinators include: Producing a last will and testament Establishing trust accounts Calling an administrator and power of lawyers Determining all recipients Naming a guardian for small kids Paying all debts and reducing all taxes and legal charges Crafting guidelines for passing your worths Developing choices for funeral plans Finalizing guidelines for treatment if you become ill and are not able to choose Acquiring life insurance policy, impairment income insurance coverage, and long-lasting care insurance coverage A great estate strategy need to be updated routinely as clients' economic scenarios, individual motivations, and government and state laws all evolve

Just like any type of occupation, there are attributes and skills that can aid you attain these objectives as you collaborate with your customers in an estate organizer duty. An estate preparation profession can be best for you if you possess the adhering to qualities: Being an estate planner means assuming in the lengthy term.

Top Guidelines Of Estate Planning Attorney

You should help your customer expect his/her end of life and what will take place postmortem, while at the exact same time not house on morbid ideas or emotions. Some click this site clients may come to be bitter or distraught when contemplating fatality and it could drop to you to aid them with it.

In case of fatality, you might be expected to have countless discussions and ventures with enduring relative concerning the estate strategy. In order to stand out as an estate coordinator, you may require to walk a great line of being a shoulder to lean on and the private trusted to connect estate planning matters in a prompt and expert way.

tax obligation code altered countless times in the 10 years in between 2001 and 2012. Expect that it has actually been altered even more because then. Relying on your customer's economic revenue brace, which may advance towards end-of-life, you as an estate coordinator will certainly have to maintain your customer's possessions completely lawful conformity with any type explanation of local, government, or global tax obligation laws.

Unknown Facts About Estate Planning Attorney

Getting this certification from companies like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Being a participant of these professional teams can validate your abilities, making you more eye-catching in the eyes of a possible client. In addition to the psychological benefit of helping customers with end-of-life planning, estate coordinators delight in the advantages of a secure revenue.

Estate planning is an intelligent point to do no matter your existing health and wellness and financial condition. However, not so several people know where to start the process. The first crucial point is to work with an estate preparation attorney to assist you with it. The complying with are five advantages of dealing with an estate planning lawyer.

The percentage of people that don't know how to obtain a will has actually increased from 4% to 7.6% because 2017. An experienced attorney knows what details to consist of in the will, including your beneficiaries and special considerations. A will secures your family members from loss due to the fact that of immaturity or incompetency. It additionally gives the swiftest and most efficient method to move your possessions to your beneficiaries.